Mastering Your Finances With The Mint Budget App: A Comprehensive Guide

In today's fast-paced world, managing your finances effectively is more important than ever, and the Mint Budget App is here to help you achieve just that. This powerful financial tool offers users a way to track their spending, create budgets, and achieve their financial goals effortlessly. In this article, we will explore the ins and outs of the Mint Budget App, how it works, its features, and why it has become a go-to solution for millions of users worldwide.

Whether you are looking to save for a vacation, pay off debt, or simply gain better control over your daily expenses, the Mint Budget App can be a game-changer. By leveraging technology, Mint not only simplifies budgeting but also empowers users to make informed financial decisions. Join us as we delve into the various aspects of this popular app, providing you with all the information you need to harness its full potential.

From its user-friendly interface to its robust financial tracking capabilities, the Mint Budget App has garnered rave reviews from users and experts alike. With over 20 million downloads, it is clear that Mint has made a significant impact on personal finance management. Let's explore how you can benefit from this innovative app and take charge of your financial future.

Table of Contents

- What is the Mint Budget App?

- Key Features of the Mint Budget App

- How Does the Mint Budget App Work?

- Setting Up Your Mint Account

- Managing Budgets with Mint

- Tracking Expenses Effectively

- Security of Your Financial Data

- Conclusion

What is the Mint Budget App?

The Mint Budget App is a free personal finance management tool developed by Intuit, designed to help users track their spending, create budgets, and manage their finances all in one place. Launched in 2006, Mint has grown to become one of the most popular budgeting apps in the market, serving millions of users globally.

Why Choose Mint?

- Free to use with no hidden fees

- User-friendly interface

- Comprehensive financial tracking

- Customizable budgeting options

- Access to financial advice and tips

Key Features of the Mint Budget App

Mint offers a wide array of features that cater to different financial needs. Here are some of the standout features that make Mint a top choice for budgeting:

1. Budgeting Tools

Mint allows users to create customizable budgets based on their income and expenses, providing insights into spending habits and helping to allocate funds effectively.

2. Expense Tracking

The app automatically categorizes transactions and tracks spending in real-time, making it easier for users to understand where their money is going.

3. Bill Tracking

Users can set up reminders for upcoming bills, ensuring they never miss a payment and helping to maintain a good credit score.

4. Credit Score Monitoring

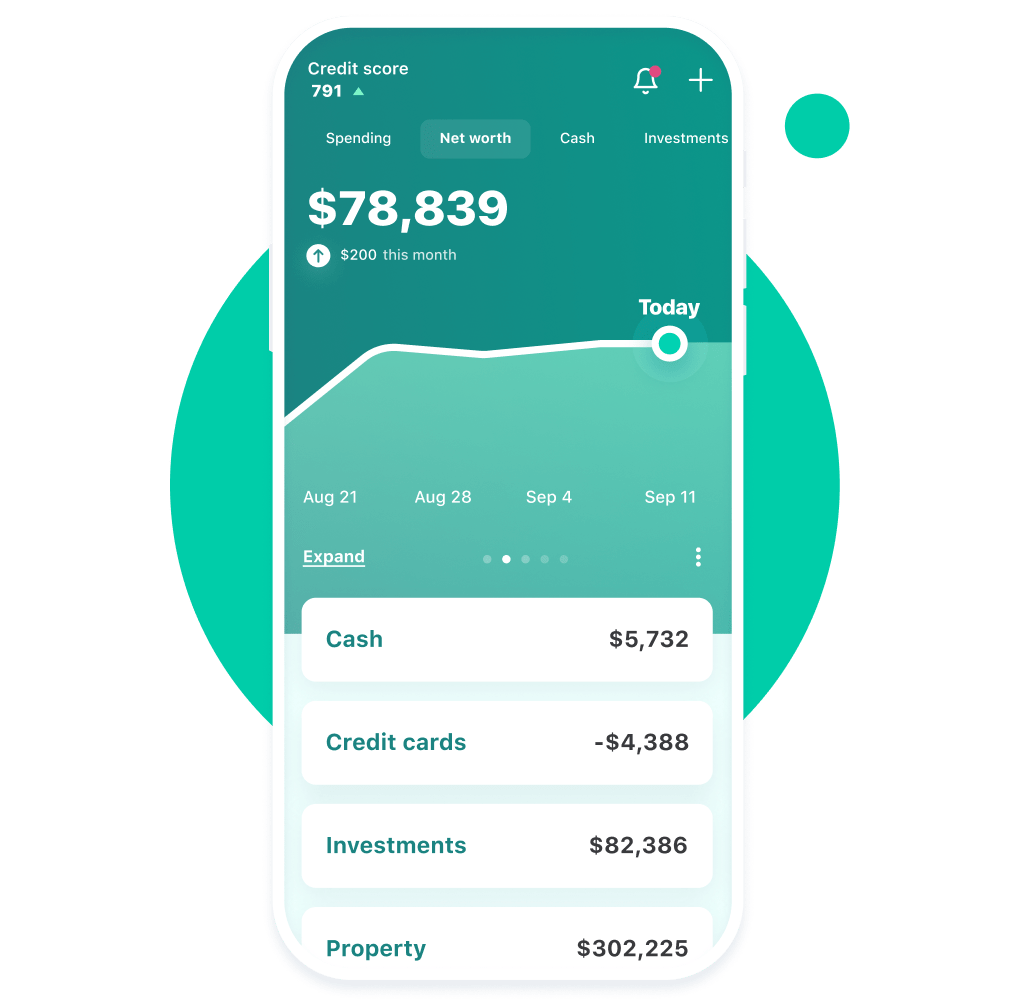

Mint provides free access to users' credit scores, along with tips on how to improve and maintain good credit.

5. Financial Insights

The app offers personalized financial insights and tips based on users' spending patterns and financial goals.

How Does the Mint Budget App Work?

The Mint Budget App works by linking to users' bank accounts, credit cards, and other financial accounts to provide a comprehensive overview of their financial situation. Here's how it functions:

1. Account Linking

Users can securely link their financial accounts to Mint, allowing the app to pull transaction data automatically. This feature is essential for accurate expense tracking and budgeting.

2. Data Categorization

Mint automatically categorizes transactions into predefined categories (e.g., groceries, dining, entertainment), which helps users analyze their spending habits.

3. Budget Creation

After linking accounts, users can create budgets tailored to their financial goals, enabling them to set spending limits for each category.

Setting Up Your Mint Account

Getting started with Mint is a straightforward process. Follow these steps to set up your account:

- Download the Mint app from the App Store or Google Play.

- Create an account using your email address or sign in with an existing Intuit account.

- Link your bank accounts, credit cards, and bills for automatic tracking.

- Set your financial goals and create a budget based on your spending habits.

Managing Budgets with Mint

Once your account is set up, managing budgets becomes a seamless experience. Here are some tips for effective budget management using Mint:

1. Regularly Review Your Budgets

Check your budgets frequently to ensure you are staying within your limits and making adjustments as needed.

2. Set Realistic Goals

Be realistic about your spending habits when creating budgets. Set achievable goals to avoid feeling overwhelmed.

3. Utilize Alerts and Notifications

Enable notifications to receive alerts when you're close to exceeding your budget in any category.

Tracking Expenses Effectively

Effective expense tracking is crucial for successful budgeting. Mint simplifies this process with the following features:

1. Automatic Transaction Import

Mint automatically imports transactions from linked accounts, saving you the hassle of manual entry.

2. Spending Insights

The app provides visual representations of spending trends, allowing users to identify areas where they can cut back.

3. Categorization Flexibility

Users can edit categories and create custom categories to better reflect their spending habits.

Security of Your Financial Data

One of the primary concerns for users when using financial apps is data security. Mint takes this seriously:

- Multi-factor authentication for account access

- Bank-level encryption to protect user data

- Regular security audits to ensure data integrity

Conclusion

In conclusion, the Mint Budget App is a powerful financial tool that helps users take control of their finances through effective budgeting and expense tracking. With its user-friendly interface and comprehensive features, Mint has become a trusted choice for millions of users worldwide. Start your journey towards financial freedom by downloading the Mint Budget App today, and experience the benefits of smart budgeting firsthand!

We encourage you to leave a comment below sharing your experiences with the Mint Budget App or any other budgeting tools you prefer. Don't forget to share this article with your friends and family who might also benefit from mastering their finances!

Thank you for reading, and we hope to see you back for more financial tips and insights!

Zooey Deschanel: A Glimpse Into Her Life As A Mother

Taylor Swift And Her Private Jet: A Comprehensive Overview

Exploring The Benefits And Insights Of Darkness Retreats