The Stock Price: Understanding Its Dynamics And Impact On Investors

The stock price is a fundamental concept in the world of finance that captures the attention of investors, analysts, and even everyday individuals interested in the market. Understanding the stock price is crucial for anyone looking to invest or simply keep an eye on their financial health. In this article, we will delve into the intricacies of stock prices, exploring their determinants, significance, and how they influence investment decisions.

The dynamics of stock prices can be complex, influenced by various factors ranging from company performance to broader economic trends. By gaining insight into these elements, investors can make informed decisions and strategically navigate the stock market. This article aims to provide a comprehensive overview of stock prices, ensuring readers grasp the key concepts and nuances involved.

As we explore the world of stock prices, we will address frequently asked questions, provide valuable statistics, and offer expert insights to enhance your understanding. Whether you are a seasoned investor or a newcomer, this guide will serve as a valuable resource for navigating the intricate landscape of stock prices.

Table of Contents

- What is Stock Price?

- Factors Affecting Stock Price

- Importance of Stock Price

- Stock Price and Investment Strategy

- Stock Price Analysis Techniques

- Case Studies: Stock Price Movements

- The Future of Stock Price Trends

- Conclusion

What is Stock Price?

Stock price refers to the current market price at which a share of a company's stock can be bought or sold. It is determined by the supply and demand dynamics in the market, reflecting how much investors are willing to pay for a share at any given moment. The stock price fluctuates based on various internal and external factors, making it a vital indicator of a company's performance and market sentiment.

Understanding Stock Price Terms

- Market Capitalization: The total market value of a company's outstanding shares. It is calculated by multiplying the stock price by the total number of shares.

- Price-to-Earnings Ratio (P/E Ratio): A valuation ratio calculated by dividing the current share price by its earnings per share (EPS). It helps investors assess whether a stock is overvalued or undervalued.

- Dividend Yield: A financial ratio that shows how much a company pays in dividends each year relative to its stock price.

Factors Affecting Stock Price

Several factors can influence stock prices, including:

Internal Factors

- Company Financial Performance: Earnings reports, revenue growth, and profit margins directly impact stock prices.

- Management Decisions: Strategic decisions made by the company's leadership can lead to shifts in investor confidence.

External Factors

- Market Trends: Overall market conditions, including bull or bear markets, can affect stock prices broadly.

- Economic Indicators: Inflation rates, unemployment rates, and GDP growth can influence investor sentiment and stock prices.

- Global Events: Political instability, natural disasters, or global financial crises can lead to stock price volatility.

Importance of Stock Price

The stock price serves several important functions in the financial ecosystem:

- Investment Decisions: Investors use stock prices to determine potential returns and make buy/sell decisions.

- Market Sentiment: Fluctuations in stock prices can indicate overall market sentiment and investor confidence.

- Company Valuation: Stock prices play a critical role in determining a company's market value and investment attractiveness.

Stock Price and Investment Strategy

Understanding stock prices is essential for developing a sound investment strategy. Here are some strategies based on stock price analysis:

- Value Investing: Investors look for undervalued stocks based on their intrinsic value compared to their current stock price.

- Growth Investing: This strategy focuses on companies with strong growth potential, regardless of their current stock price.

- Technical Analysis: Traders analyze historical price movements and patterns to predict future stock price movements.

Stock Price Analysis Techniques

Investors and analysts use various techniques to analyze stock prices, including:

Fundamental Analysis

This technique involves evaluating a company's financial statements, management, market position, and economic factors to determine its stock price's potential.

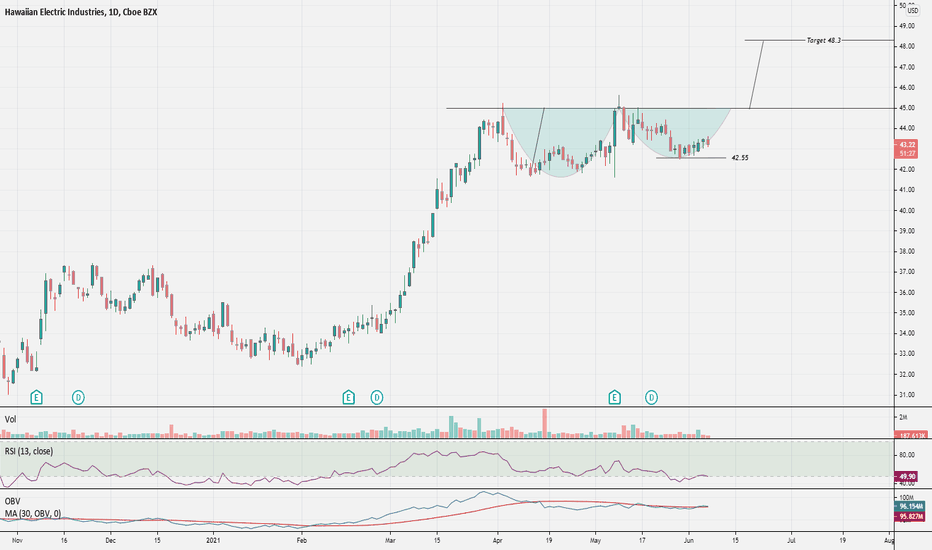

Technical Analysis

Technical analysis focuses on historical price movements and trading volumes to identify potential future price movements. It relies on charts and various indicators.

Case Studies: Stock Price Movements

Examining real-world case studies can provide insights into how stock prices react to specific events:

- The Dot-Com Bubble (1995-2000): This period saw massive stock price increases for technology companies, driven by speculation. The eventual crash led to significant losses for investors.

- The 2008 Financial Crisis: Major financial institutions faced collapse, leading to drastic declines in stock prices across multiple sectors.

- The COVID-19 Pandemic (2020): Stock prices experienced extreme volatility due to uncertainty, leading to rapid sell-offs and subsequent recoveries as markets adjusted.

The Future of Stock Price Trends

As we look ahead, several trends may influence future stock prices:

- Technological Advancements: Innovations in technology may lead to new market opportunities and affect stock prices accordingly.

- ESG Investing: Environmental, Social, and Governance (ESG) factors are becoming increasingly important, potentially impacting stock valuations.

- Global Economic Changes: Shifts in the global economy, trade policies, and geopolitical events will continue to play a role in stock price movements.

Conclusion

In summary, understanding the stock price is essential for anyone involved in investing or interested in the financial markets. By considering the factors that influence stock prices, the importance of these prices, and various analytical techniques, investors can make informed decisions. We encourage you to engage with this topic further—leave a comment below, share this article, or explore other insights available on our site.

As we continue to navigate the complexities of the financial landscape, we invite you to return for more in-depth articles and updates on stock prices and investment strategies.

Understanding Laes Stock: A Comprehensive Guide To Investment Opportunities

Aquarius Scorpio Match: A Comprehensive Guide

Understanding The Federal Poverty Level: A Comprehensive Guide