Understanding NYSE KO: A Comprehensive Guide To The Coca-Cola Company On The New York Stock Exchange

The New York Stock Exchange (NYSE) is home to many prominent companies, and among them is The Coca-Cola Company, commonly referred to by its stock ticker symbol, KO. In this article, we will delve into the details of NYSE KO, providing insights into its historical background, market performance, and future prospects. Coca-Cola, a globally recognized brand, has a significant impact on the beverage industry and the stock market, making it essential for investors and enthusiasts to understand.

As we explore NYSE KO, we will cover various aspects, including the company's history, key financial metrics, dividend policies, and recent market trends. With a focus on providing valuable information, this article aims to serve as a reliable resource for anyone interested in investing in Coca-Cola or simply learning more about its market presence.

By the end of this article, readers will have a clearer understanding of NYSE KO, enabling them to make informed decisions regarding their investments. Whether you are a seasoned investor or a newcomer to the stock market, this comprehensive guide will equip you with the knowledge necessary to navigate the complexities of investing in one of the world's most iconic brands.

Table of Contents

- 1. History of The Coca-Cola Company

- 2. Key Financial Metrics of NYSE KO

- 3. Dividend Policies and History

- 4. Market Performance and Trends

- 5. Competitors and Market Position

- 6. Future Prospects of NYSE KO

- 7. Investing in NYSE KO: Pros and Cons

- 8. Conclusion

1. History of The Coca-Cola Company

The Coca-Cola Company was founded in 1886 by Dr. John Stith Pemberton in Atlanta, Georgia. Originally created as a medicinal tonic, Coca-Cola quickly evolved into a popular soft drink. In 1892, Asa Candler acquired the rights to the beverage and established The Coca-Cola Company, which began its journey towards becoming a global powerhouse.

Throughout the 20th century, Coca-Cola expanded its product offerings and distribution networks, solidifying its position as a leader in the beverage industry. The company's marketing strategies, including iconic advertisements and sponsorships, contributed to its enduring brand recognition.

Key Milestones in Coca-Cola's History

- 1886: Coca-Cola is invented by Dr. John Stith Pemberton.

- 1892: The Coca-Cola Company is established.

- 1919: Coca-Cola goes public on the New York Stock Exchange.

- 1982: Diet Coke is introduced, catering to the growing health-conscious market.

- 2000s: Coca-Cola expands its product line to include bottled water, teas, and energy drinks.

2. Key Financial Metrics of NYSE KO

Investors looking at NYSE KO should consider various financial metrics to assess the company's performance. These metrics provide insights into the company's profitability, liquidity, and overall financial health.

Major Financial Metrics

- Market Capitalization: As of 2023, Coca-Cola's market capitalization stands at approximately $240 billion.

- Revenue: In 2022, Coca-Cola reported a revenue of around $43 billion.

- Earnings Per Share (EPS): The company's EPS for the last fiscal year was $2.08.

- Price-to-Earnings (P/E) Ratio: Coca-Cola's P/E ratio is currently 24.5, indicating market confidence in its future growth.

3. Dividend Policies and History

Coca-Cola is renowned for its commitment to returning value to shareholders through dividends. The company has a long history of steady dividend payments, making it an attractive option for income-focused investors.

Coca-Cola's Dividend Track Record

- Coca-Cola has increased its dividend for over 60 consecutive years.

- The current dividend yield is approximately 3.0%.

- In 2023, the quarterly dividend per share was raised to $0.44.

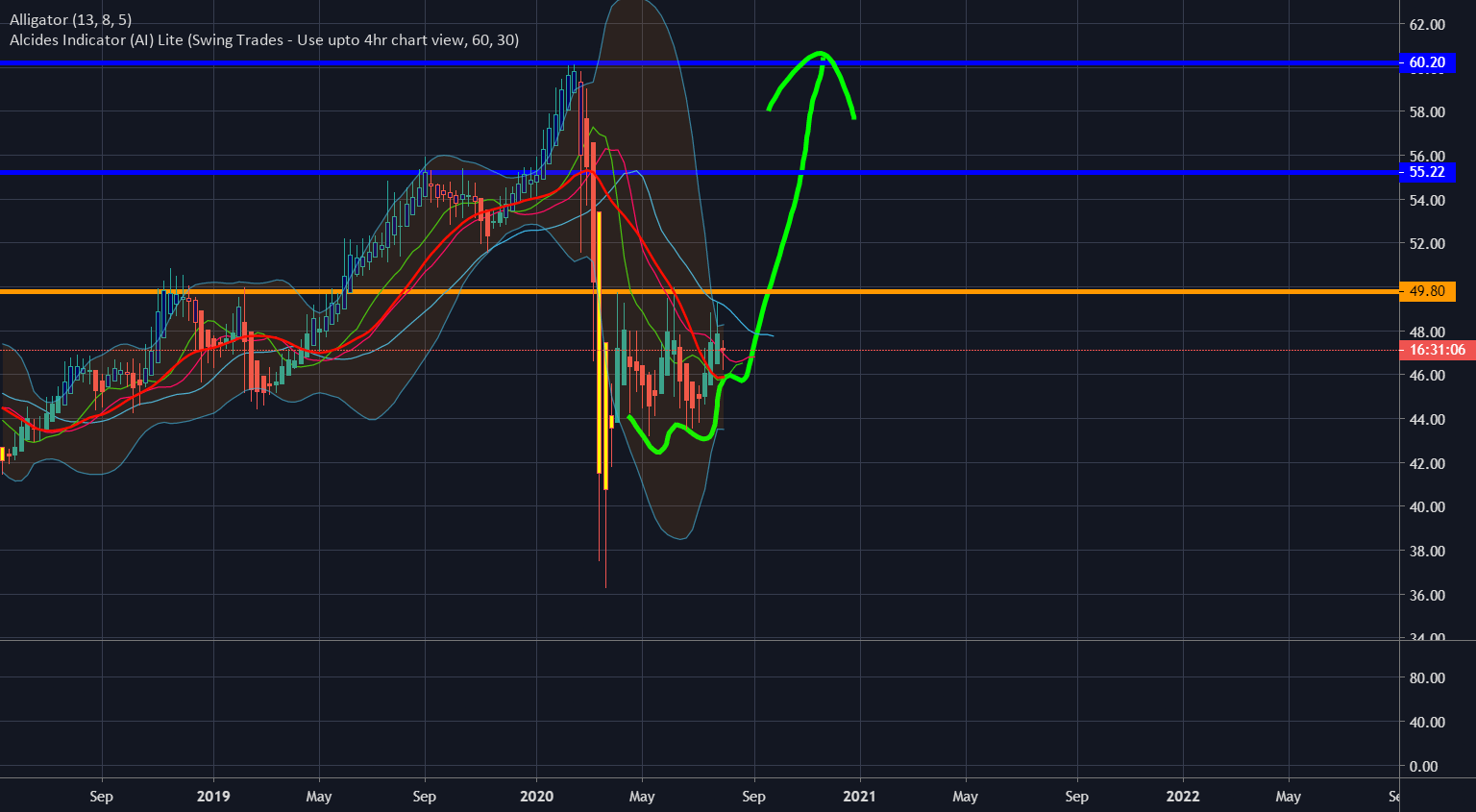

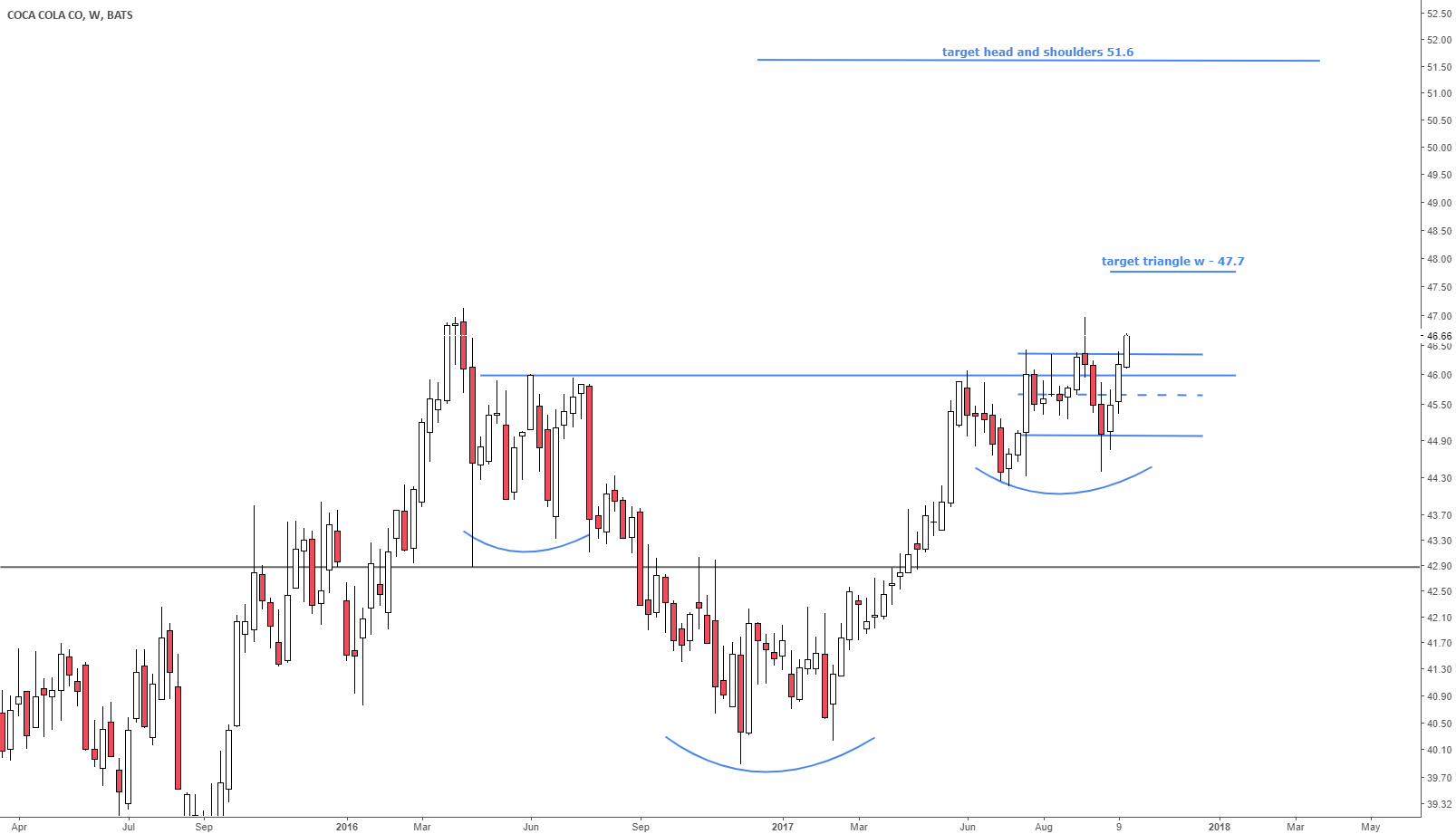

4. Market Performance and Trends

The performance of NYSE KO is influenced by various market trends and economic factors. Understanding these trends is crucial for investors looking to make informed decisions.

Recent Market Trends

- Coca-Cola has seen a resurgence in demand for its products as consumer preferences shift towards healthier options.

- The company's stock performance has been stable, with a gradual upward trend over the past five years.

- In 2023, Coca-Cola's stock price reached an all-time high, driven by robust earnings reports and positive market sentiment.

5. Competitors and Market Position

Coca-Cola operates in a highly competitive beverage market. Understanding its competitors is essential for grasping its market position.

Key Competitors

- PepsiCo (PEP): The primary competitor, offering a wide range of beverages and snacks.

- Dr Pepper Snapple Group: A significant player in the soft drink market.

- Nestlé: Competes in bottled water and non-carbonated beverages.

6. Future Prospects of NYSE KO

The future of Coca-Cola looks promising, with several strategic initiatives in place aimed at growth and sustainability. The company is focusing on diversifying its product portfolio and enhancing its sustainability efforts.

Strategic Initiatives

- Investment in health-focused products and low-sugar alternatives.

- Expansion into emerging markets with growing demand for beverages.

- Commitment to reducing plastic waste and promoting environmentally friendly packaging.

7. Investing in NYSE KO: Pros and Cons

Investing in NYSE KO comes with its advantages and disadvantages. Understanding these can help investors make informed choices.

Pros

- Strong brand loyalty and global recognition.

- Consistent dividend payments provide income stability.

- Diverse product offerings cater to changing consumer preferences.

Cons

- Intense competition may impact market share.

- Shifts in consumer preferences towards healthier options may challenge traditional products.

- Economic downturns could affect sales and profitability.

8. Conclusion

In summary, NYSE KO represents a significant opportunity for investors looking to engage with a well-established company in the beverage industry. With a rich history, solid financial performance, and a robust dividend policy, Coca-Cola continues to be a reliable choice for both income and growth-oriented investors. However, it is essential to consider market competition and shifting consumer preferences when making investment decisions.

We encourage readers to leave comments, share this article, or explore other informative articles on our site. Your engagement helps us create more valuable content for you.

Final Thoughts

As you continue your investment journey, remember to stay informed and keep an eye on market trends. We hope to see you back on our site for more insights and updates related to the stock market and investment opportunities.

South Carolina Vs LSU: A Comprehensive Analysis Of The Rivalry

Understanding FTSE: A Comprehensive Guide To The Financial Times Stock Exchange

Understanding Christian McCaffrey's Injury: A Comprehensive Analysis