Understanding VTNR Stock: A Comprehensive Guide For Investors

VTNR stock has garnered significant attention from investors in recent years, primarily due to its unique position in the renewable energy sector. As the world shifts towards sustainable energy solutions, companies like Vertex Energy, Inc. (VTNR) are at the forefront of this transformation. In this article, we will delve into the intricacies of VTNR stock, exploring its performance, underlying business model, and future prospects. Whether you're a seasoned investor or just starting, understanding VTNR stock will equip you with the knowledge needed to make informed decisions.

The renewable energy sector has seen exponential growth, with many investors looking to capitalize on this trend. VTNR, a company specializing in the recovery and recycling of petroleum waste, stands out in this booming market. Their innovative approaches to energy recovery not only contribute to environmental sustainability but also present lucrative opportunities for investors. This article aims to provide a detailed analysis of VTNR, including its financial health, market position, and strategic initiatives.

In the following sections, we will break down various aspects related to VTNR stock, including its market performance, competitive landscape, and potential risks. Our goal is to provide a holistic view of this stock, ensuring that you have all the necessary information to make well-informed investment choices.

Table of Contents

- Biography of Vertex Energy, Inc.

- Financial Performance of VTNR Stock

- Market Analysis: VTNR and Its Competitors

- Future Prospects of VTNR Stock

- Investment Strategy for VTNR Stock

- Risks and Challenges Facing VTNR

- Sustainable Energy Trends Impacting VTNR

- Conclusion

Biography of Vertex Energy, Inc.

Vertex Energy, Inc. (NASDAQ: VTNR) is a leading specialty refiner of alternative feedstocks and a provider of innovative environmental solutions. Founded in 2008, the company focuses on the collection and recycling of used motor oil and other petroleum waste products. Over the years, VTNR has positioned itself as a key player in the renewable energy sector, leveraging advanced technologies to recover valuable materials from waste.

Personal Data and Company Profile

| Company Name | Vertex Energy, Inc. |

|---|---|

| Ticker Symbol | VTNR |

| Founded | 2008 |

| Headquarters | Houston, Texas, USA |

| Industry | Renewable Energy, Oil Recycling |

| Website | vertexenergy.com |

Financial Performance of VTNR Stock

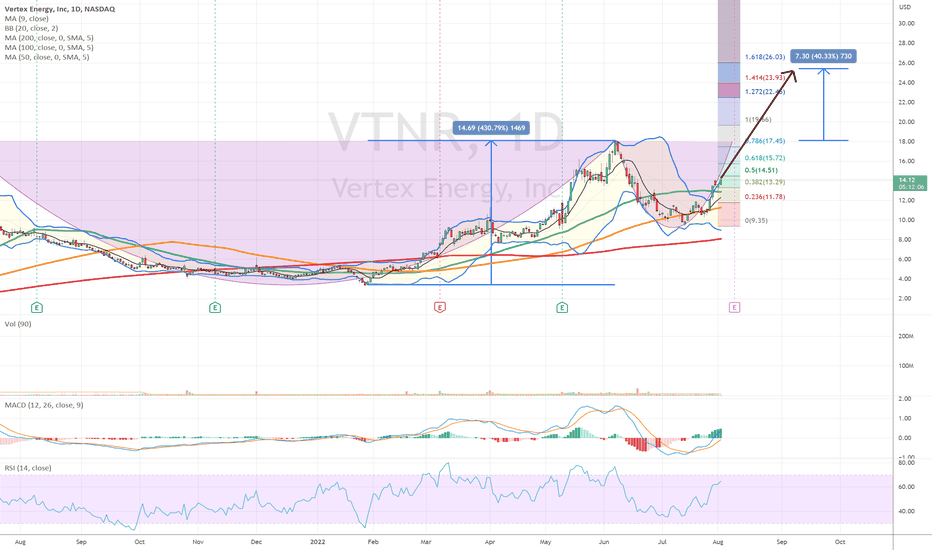

To evaluate the investment potential of VTNR stock, it is crucial to analyze its financial performance. This includes examining revenue growth, profitability, and stock price trends.

Revenue Growth

- VTNR has experienced significant revenue growth over the past few years, driven by increased demand for sustainable energy solutions.

- The company reported a revenue increase of 35% year-over-year in its latest financial report.

Profitability Metrics

The profitability of VTNR is another critical aspect for potential investors. Key metrics include:

- Gross Margin: VTNR has maintained a gross margin of around 20%, reflecting efficient operations.

- Net Income: The company reported a net income of $5 million in the last fiscal year, showcasing its ability to generate profits.

Market Analysis: VTNR and Its Competitors

Understanding the competitive landscape is essential for investors. VTNR operates in a niche market with several competitors, including established players and emerging startups.

Key Competitors

- Clean Harbors, Inc. (CLH)

- Heritage-Crystal Clean, Inc. (HCCI)

- Safety-Kleen Systems, Inc.

Market Positioning

VTNR differentiates itself through its innovative recycling processes and commitment to sustainability. This positioning not only attracts environmentally conscious clients but also enhances its brand value in the marketplace.

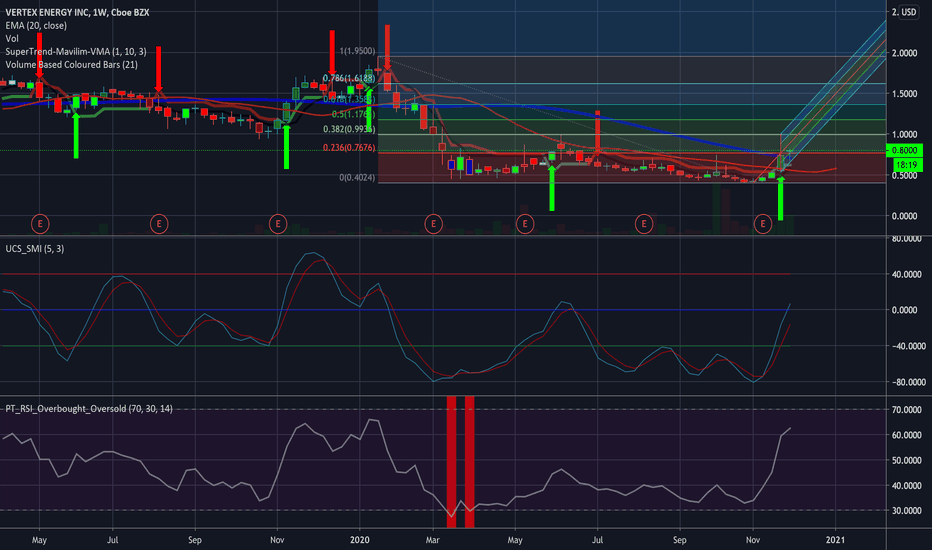

Future Prospects of VTNR Stock

The future prospects of VTNR stock appear promising, driven by several factors:

Expansion into New Markets

- VTNR plans to expand its operations into international markets, tapping into the growing demand for renewable energy solutions.

- Strategic partnerships with other companies will enhance its market reach and operational capabilities.

Technological Advancements

Investing in new technologies will enable VTNR to improve efficiency and reduce costs, further solidifying its competitive advantage.

Investment Strategy for VTNR Stock

When considering an investment in VTNR stock, it's essential to develop a well-rounded strategy:

- Diversification: Consider diversifying your portfolio to mitigate risks associated with market fluctuations.

- Long-Term Outlook: With its focus on sustainability, VTNR presents a long-term investment opportunity in the renewable energy sector.

Risks and Challenges Facing VTNR

Despite its promising outlook, VTNR faces several risks that investors should be aware of:

Market Volatility

The renewable energy market can be volatile, influenced by changes in regulations and consumer preferences.

Operational Risks

- As a company heavily reliant on technology, any operational failures could significantly impact performance.

- Supply chain disruptions may also pose risks to VTNR's ability to deliver products and services.

Sustainable Energy Trends Impacting VTNR

Several trends in the sustainable energy sector may influence VTNR's growth trajectory:

Increasing Demand for Renewable Energy

As governments and corporations commit to reducing carbon emissions, the demand for renewable energy solutions is expected to rise steadily.

Regulatory Support

- Government incentives for renewable energy projects can bolster VTNR's growth prospects.

- Supportive policies may enhance the company's ability to secure funding and partnerships.

Conclusion

In summary, VTNR stock represents a compelling opportunity for investors looking to enter the renewable energy market. With its strong financial performance, innovative solutions, and favorable market conditions, VTNR is well-positioned for future growth. However, it is essential to consider potential risks and develop a sound investment strategy. As always, we encourage investors to conduct thorough research and stay informed about market trends.

We invite you to share your thoughts on VTNR stock in the comments section below. If you found this article helpful, feel free to share it with fellow investors or explore more articles on our site for further insights.

Thank you for reading, and we look forward to seeing you again soon!

Understanding NYSE: NEM - A Comprehensive Guide To Newmont Corporation

Yahoo Change Password: A Complete Guide To Secure Your Account

Understanding General Electric Stock Price: Trends, Analysis, And Future Outlook