PGE Stock Price: An In-Depth Analysis And Forecast

The PGE stock price has been a topic of significant interest among investors and financial analysts alike. As the market continues to evolve, understanding the factors influencing PGE's stock performance becomes essential for making informed investment decisions. This article delves into the intricacies of PGE stock price, exploring its historical performance, current trends, and future projections. Whether you are a seasoned investor or a newcomer to the stock market, this comprehensive guide aims to provide you with valuable insights into PGE stock.

In this article, we will examine the various elements that contribute to the fluctuation of PGE's stock price, including market trends, company performance, and external economic factors. Additionally, we will discuss the significance of PGE as a player in the energy sector and how its stock performance can impact investors. By the end of this article, you will have a clearer understanding of PGE stock price movements and what they mean for your investment strategy.

As we navigate through the complex landscape of the stock market, staying informed is crucial. This guide is designed to equip you with the knowledge needed to analyze PGE's stock price effectively. We will also touch upon potential investment strategies and the importance of diversifying your portfolio in relation to PGE stock. Let’s dive into the world of PGE stock price and uncover the insights that can shape your investment decisions.

Table of Contents

- 1. Understanding PGE: Company Overview

- 2. Historical Performance of PGE Stock Price

- 3. Factors Influencing PGE Stock Price

- 4. Current Market Trends for PGE Stock

- 5. Future Projections for PGE Stock Price

- 6. Investment Strategies Involving PGE Stock

- 7. Risks and Considerations in Investing in PGE Stock

- 8. Conclusion and Final Thoughts

1. Understanding PGE: Company Overview

PGE, or Portland General Electric, is one of the leading utilities in the United States, primarily serving the Oregon area. The company is dedicated to providing safe and reliable electric service to its customers while also focusing on sustainable energy practices. Established in 1888, PGE has a long history of adapting to the changing energy landscape, including a commitment to renewable energy sources.

1.1 PGE's Mission and Vision

PGE’s mission is to deliver energy safely, reliably, and sustainably. The company's vision emphasizes the importance of innovation and environmental stewardship, aiming to reduce its carbon footprint while meeting the energy needs of its customers.

1.2 Key Services Offered by PGE

- Residential and commercial electricity services

- Renewable energy solutions

- Energy efficiency programs

- Grid modernization initiatives

2. Historical Performance of PGE Stock Price

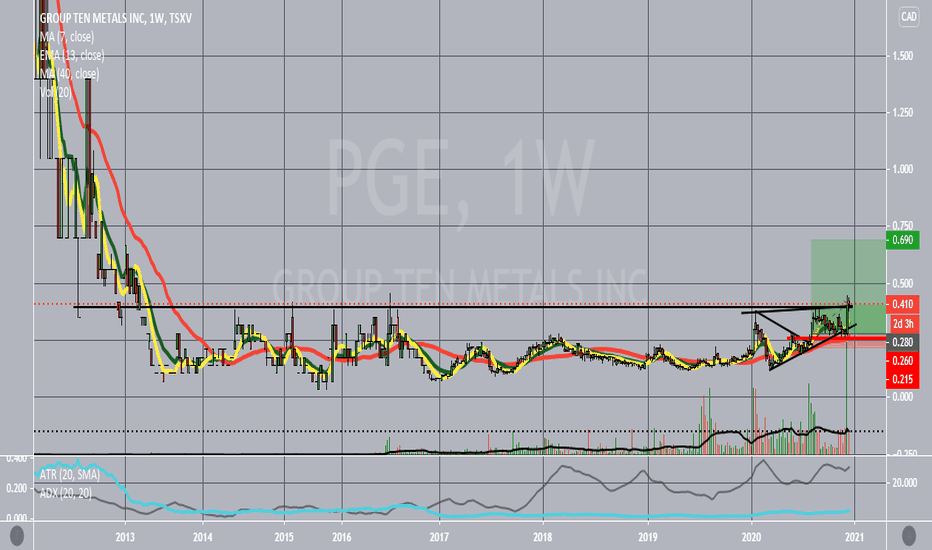

To understand the current PGE stock price, it is essential to analyze its historical performance. PGE has experienced various phases of growth and decline, influenced by both internal company performance and external market conditions.

2.1 Stock Price Trends Over the Years

Over the past decade, PGE's stock price has shown a general upward trend, with some fluctuations. Key events that have impacted its stock price include:

- Regulatory changes affecting utility rates

- Shifts in energy policy favoring renewable sources

- Market reactions to quarterly earnings reports

2.2 Comparison with Industry Peers

When comparing PGE's stock price with other utility companies, it becomes evident that PGE has maintained a competitive edge, particularly in its adoption of renewable energy initiatives. This focus has not only bolstered its public image but has also attracted environmentally conscious investors.

3. Factors Influencing PGE Stock Price

Several factors contribute to the fluctuations in PGE stock price. Understanding these factors can help investors make informed decisions.

3.1 Economic Indicators

The overall economic climate plays a significant role in PGE's stock performance. Key economic indicators include:

- Interest rates

- Inflation rates

- Unemployment rates

3.2 Regulatory Environment

As a utility company, PGE is heavily influenced by governmental regulations. Changes in energy policy, environmental regulations, and utility rate structures can have immediate effects on the stock price.

4. Current Market Trends for PGE Stock

Currently, PGE stock is reflecting the broader trends in the energy sector, especially as more investors prioritize sustainability. Recent market developments have shown a growing interest in companies that focus on renewable energy solutions.

4.1 Recent Stock Performance

In the last quarter, PGE stock has seen a slight increase, attributed to positive earnings reports and a favorable regulatory environment for renewable energy investments.

4.2 Analysts' Ratings

Analysts have generally maintained a positive outlook on PGE stock, suggesting that it remains a strong investment choice in the utility sector.

5. Future Projections for PGE Stock Price

Looking ahead, analysts forecast a promising future for PGE stock. Several factors contribute to this optimism:

5.1 Investment in Renewable Energy

PGE's commitment to expanding its renewable energy portfolio is expected to drive growth and enhance stock value. Initiatives for solar and wind energy projects are likely to attract further investments.

5.2 Technological Advancements

Ongoing advancements in energy technology can improve efficiency and reduce costs, positively impacting PGE's bottom line and stock price.

6. Investment Strategies Involving PGE Stock

For investors considering PGE stock, several strategies can be employed to maximize returns:

6.1 Long-Term Investment

Given PGE's stability and growth potential, a long-term investment strategy may be beneficial. Investors can benefit from dividends and capital appreciation over time.

6.2 Diversification

Incorporating PGE stock into a diversified portfolio can help mitigate risks associated with market volatility. Investors should consider balancing their investments across different sectors.

7. Risks and Considerations in Investing in PGE Stock

While PGE stock presents several opportunities, it is also essential to consider the risks involved:

7.1 Market Volatility

The stock market is inherently volatile. PGE stock may experience fluctuations due to broader market conditions or shifts in the energy sector.

7.2 Regulatory Risks

Changes in regulations can significantly impact utility companies. Investors must stay informed about potential legislative changes that could affect PGE’s operations and profitability.

8. Conclusion and Final Thoughts

In conclusion, understanding PGE stock price is crucial for making informed investment decisions. With a strong commitment to renewable energy and a solid market position, PGE presents a compelling opportunity for investors. However, it is essential to remain aware of the market risks and regulatory challenges that may arise.

We encourage you to share your thoughts and experiences regarding PGE stock in the comments below. If you found this article helpful, consider sharing it with others or exploring more articles on our site to enhance your investment knowledge.

Thank you for reading! We look forward to seeing you again for more insightful information on investing and market trends.

Aquaman: The Lost Kingdom - Amber Heard's Role And Impact

Exploring The Life Of Josh Hutcherson's Brother: A Deep Dive Into Their Relationship

What Time Are The Playoff Games? A Comprehensive Guide