Understanding CAT Stock Price: Insights And Analysis

CAT stock price has been a focal point for investors and analysts alike, reflecting the performance and potential of Caterpillar Inc. This article delves into the intricacies of CAT stock, exploring its historical trends, current performance, and future outlook. Understanding the factors that influence CAT stock price is essential for making informed investment decisions, especially in today's dynamic market environment.

As one of the leading manufacturers of construction and mining equipment, Caterpillar Inc. plays a significant role in the global economy. The company's stock price is not only an indicator of its performance but also a reflection of broader economic trends. In this article, we will examine the key elements that affect CAT stock price, including market conditions, financial performance, and industry trends.

Moreover, this comprehensive analysis will provide investors with valuable insights into the stock's potential trajectory. Whether you are considering investing in CAT stock or simply want to understand its market behavior, this article aims to equip you with the necessary knowledge to navigate the complexities of stock investment.

Table of Contents

- Biography of Caterpillar Inc.

- Current Stock Performance

- Historical Stock Trends

- Factors Influencing CAT Stock Price

- Financial Analysis of Caterpillar Inc.

- Industry Outlook and Future Trends

- Investing Tips for CAT Stock

- Conclusion

Biography of Caterpillar Inc.

Caterpillar Inc. is a Fortune 100 company and the world's leading manufacturer of construction and mining equipment, diesel and natural gas engines, and industrial gas turbines. Founded in 1925, Caterpillar has built a reputation for quality and innovation, making it a trusted name in the industry.

| Information | Details |

|---|---|

| Founded | 1925 |

| Headquarters | Deerfield, Illinois, USA |

| CEO | Jim Umpleby |

| Industry | Construction and Mining Equipment |

| Market Capitalization | Approximately $100 billion (as of October 2023) |

Current Stock Performance

As of October 2023, CAT stock price is experiencing fluctuations influenced by various market dynamics. Investors closely monitor the stock price, which is affected by broader economic indicators, including GDP growth, infrastructure spending, and commodity prices.

Recent Stock Price Trends

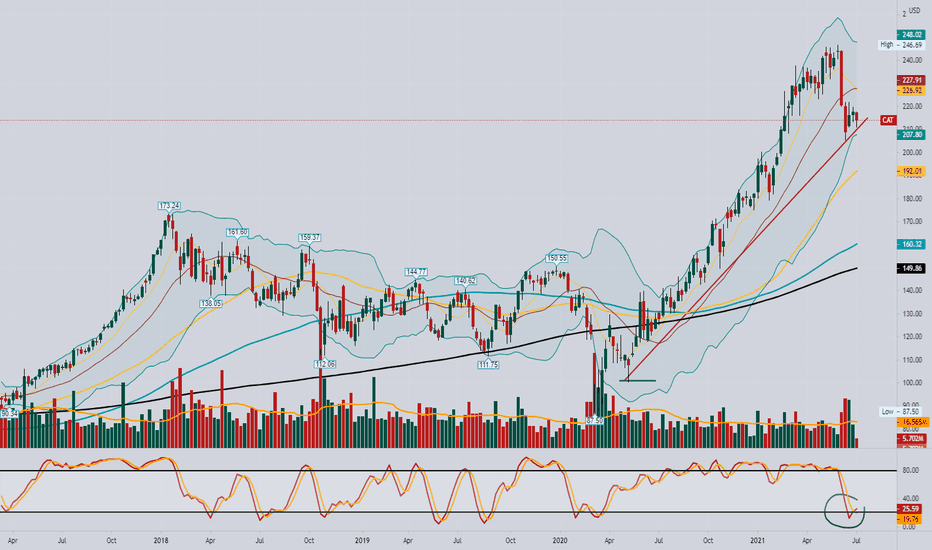

In recent months, CAT stock has shown resilience amidst market volatility. The stock price has fluctuated between $210 and $250, reflecting investor sentiment towards the company's performance and the overall economic landscape. Analyzing these trends helps investors gauge the stock's potential for future growth.

Comparative Analysis with Competitors

When evaluating CAT stock, it's essential to compare it with competitors in the industry, such as Komatsu and Volvo. This comparison provides insights into Caterpillar's market position and growth potential relative to its peers.

Historical Stock Trends

Understanding the historical performance of CAT stock can provide valuable context for current investors. Over the past decade, the stock has experienced significant growth, reflecting the company's expansion and increasing demand for its products.

Long-Term Growth Trajectory

Since 2013, CAT stock has seen a steady increase, with a notable peak in 2021. This growth can be attributed to various factors, including increased infrastructure spending and a robust global economy. However, investors should also be aware of the stock's volatility during economic downturns.

Impact of Economic Cycles

CAT stock price is closely tied to the health of the global economy. During economic booms, demand for construction and mining equipment rises, boosting sales and stock prices. Conversely, during recessions, the stock tends to decline as projects are put on hold.

Factors Influencing CAT Stock Price

Several key factors influence CAT stock price, including market conditions, economic indicators, and industry trends. Understanding these elements is crucial for predicting future stock performance.

Economic Indicators

- GDP Growth: A strong economy typically leads to increased infrastructure spending, benefiting Caterpillar.

- Commodity Prices: Fluctuations in commodity prices can impact demand for Caterpillar's equipment.

- Interest Rates: Rising interest rates can dampen construction activity, affecting sales.

Market Sentiment

Investor sentiment plays a significant role in CAT stock price movements. News related to the company's performance, economic forecasts, and geopolitical events can lead to rapid changes in stock price.

Financial Analysis of Caterpillar Inc.

Analyzing Caterpillar's financial performance is essential for understanding its stock price dynamics. Key financial metrics, such as revenue, profit margins, and earnings per share (EPS), provide insights into the company's profitability and growth potential.

Revenue and Profit Margins

Caterpillar has consistently reported strong revenue growth, driven by robust demand for its products. In 2022, the company reported revenues of approximately $60 billion, with profit margins improving due to cost-cutting measures and efficiency improvements.

Earnings per Share (EPS)

The EPS is a critical metric for investors, indicating the company's profitability on a per-share basis. CAT's EPS has shown steady growth, reflecting the company's ability to generate profits even in challenging economic conditions.

Industry Outlook and Future Trends

The construction and mining equipment industry is poised for growth, driven by increasing infrastructure investments and technological advancements. Understanding future trends is crucial for investors considering CAT stock.

Infrastructure Investments

Governments worldwide are increasing infrastructure spending, which bodes well for Caterpillar. Projects related to transportation, energy, and urban development are expected to drive demand for construction equipment.

Technological Innovations

Caterpillar is at the forefront of technological innovations, including automation and sustainability initiatives. These advancements not only improve efficiency but also position the company as a leader in the industry, potentially boosting stock performance.

Investing Tips for CAT Stock

For investors looking to invest in CAT stock, consider the following tips:

- Conduct thorough research on market conditions and economic indicators.

- Monitor Caterpillar's financial performance and earnings reports.

- Diversify your portfolio to mitigate risks associated with market volatility.

- Stay informed about industry trends and technological advancements.

Conclusion

In summary, CAT stock price is influenced by a multitude of factors, including economic conditions, market sentiment, and the company's financial performance. Understanding these elements is vital for making informed investment decisions. As Caterpillar continues to innovate and adapt to market changes, its stock remains an attractive option for investors seeking growth opportunities.

If you found this article helpful, feel free to leave a comment below, share it with others, or explore more articles on our site to enhance your investment knowledge.

Thank you for reading, and we look forward to seeing you back on our platform for more insightful articles!

Latest Quarterback News: Insights And Updates From The NFL

Understanding Druski's Net Worth: A Comprehensive Analysis

Exploring Yahoo TW: A Comprehensive Guide To Taiwan's Favorite News Portal

Insight/2018/7.2018/07.02.2018_Caterpillar/CAT stock price.jpg)