Understanding ENB Stock: A Comprehensive Guide To Enbridge Inc.

ENB stock, representing shares of Enbridge Inc., has garnered significant attention in the financial markets due to its robust performance and strategic positioning in the energy sector. This article will delve into the intricacies of ENB stock, exploring its historical performance, financial metrics, and the factors influencing its market value. Whether you are an investor looking to diversify your portfolio or simply curious about the energy market, this guide will provide you with valuable insights.

In the ever-evolving landscape of energy investments, understanding the fundamentals of ENB stock is crucial. Enbridge Inc., a Canadian multinational energy transportation company, plays a pivotal role in the movement of oil and natural gas in North America. With a legacy of reliability and innovation, Enbridge has established itself as a key player in the energy sector, making its stock a point of interest for investors.

This article aims to provide a thorough examination of ENB stock, offering insights into its historical trends, current market performance, and future prospects. By the end of this guide, readers will have a comprehensive understanding of what drives ENB stock and how it fits into the broader context of energy investments.

Table of Contents

- 1. Enbridge Overview

- 2. ENB Stock Performance Analysis

- 3. Key Financial Metrics

- 4. Factors Influencing ENB Stock Value

- 5. Investing in ENB Stock: Pros and Cons

- 6. Future Outlook for ENB Stock

- 7. Risk Considerations for ENB Investors

- 8. Conclusion

1. Enbridge Overview

Enbridge Inc. is a Canadian multinational company primarily involved in the transportation and distribution of oil and natural gas. Founded in 1949, Enbridge has grown to become one of North America's largest energy infrastructure companies. The company operates an extensive network of pipelines, storage facilities, and renewable energy projects, making it a crucial player in the energy sector.

Key Information about Enbridge Inc.

| Data Point | Details |

|---|---|

| Founded | 1949 |

| Headquarters | Calgary, Alberta, Canada |

| Industry | Energy Infrastructure |

| Market Capitalization | Approximately $100 Billion (as of October 2023) |

| Stock Symbol | ENB (NYSE) |

2. ENB Stock Performance Analysis

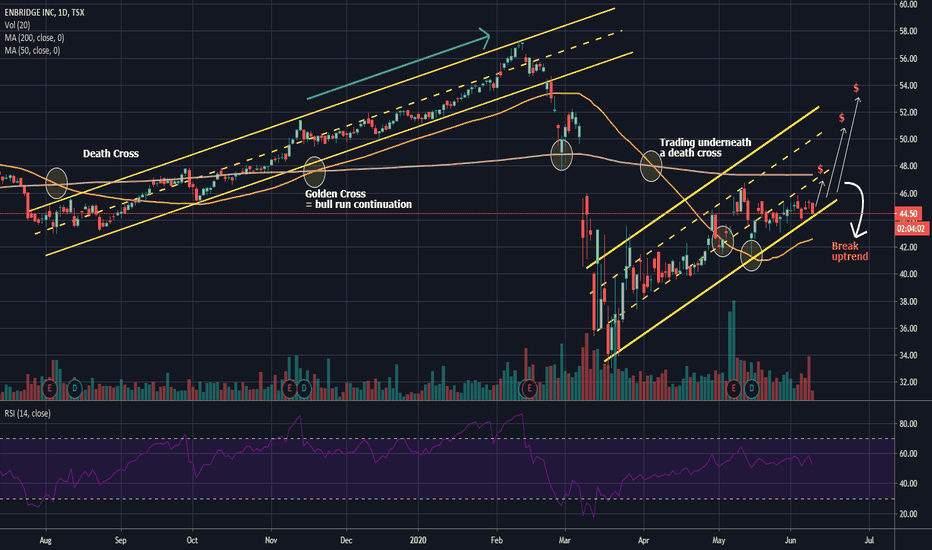

Analyzing the performance of ENB stock is essential for understanding its investment potential. The stock has shown resilience over the years, reflecting the company's steady operational performance and strategic initiatives.

Historical Stock Performance

ENB stock has experienced fluctuations typical of the energy sector, influenced by oil prices, regulatory changes, and market dynamics. Over the past decade, the stock has provided consistent dividends, appealing to income-focused investors.

Recent Market Trends

In recent months, ENB stock has demonstrated stability amidst market volatility. Factors such as rising energy demand and strategic investments in renewable energy have contributed positively to its market standing. Investors should monitor these trends to gauge potential future performance.

3. Key Financial Metrics

Understanding the financial health of Enbridge Inc. is vital for investors. Here are some key financial metrics to consider:

- Revenue: Enbridge reported revenues of approximately $50 billion in the last fiscal year.

- Net Income: The company has consistently posted positive net income, with figures around $3 billion.

- Dividend Yield: ENB stock offers a competitive dividend yield, currently around 7.5%, making it attractive for dividend-seeking investors.

- P/E Ratio: The price-to-earnings (P/E) ratio stands at approximately 20, reflecting investor confidence in the company's future growth.

4. Factors Influencing ENB Stock Value

Several factors influence the value of ENB stock, including:

Global Oil Prices

As a company heavily involved in oil transportation, fluctuations in global oil prices significantly impact ENB stock. Higher oil prices generally lead to increased revenue and profitability for Enbridge.

Regulatory Environment

The energy sector is subject to extensive regulation. Changes in environmental policies and regulatory frameworks can influence the operational landscape for Enbridge, affecting its stock performance.

5. Investing in ENB Stock: Pros and Cons

Investing in ENB stock comes with its own set of advantages and disadvantages.

Pros

- Attractive Dividend Yield: ENB stock offers one of the highest dividend yields in the sector.

- Strong Market Position: As a leading energy infrastructure company, Enbridge has a solid market presence.

- Growth Potential: Investments in renewable energy projects position Enbridge for future growth.

Cons

- Market Volatility: The energy sector is known for its volatility, which can affect stock performance.

- Regulatory Risks: Changes in regulations can impact operational costs and profitability.

- Dependency on Oil Prices: Fluctuations in oil prices can directly affect revenue streams.

6. Future Outlook for ENB Stock

The future outlook for ENB stock appears promising, driven by several factors:

- Transition to Renewable Energy: Enbridge's investment in renewable energy projects aligns with global energy trends, positioning the company for long-term growth.

- Infrastructure Development: Ongoing infrastructure projects are expected to enhance operational capacity and revenue generation.

- Strong Demand: With the increasing demand for energy, Enbridge is well-positioned to capitalize on market opportunities.

7. Risk Considerations for ENB Investors

While ENB stock presents many opportunities, investors should consider the following risks:

- Market Fluctuations: Economic downturns and changes in energy prices can affect stock performance.

- Regulatory Challenges: Unforeseen regulatory changes can impact operations and profitability.

- Environmental Concerns: Increased focus on environmental sustainability can influence investor sentiment and company operations.

8. Conclusion

In summary, ENB stock represents a significant investment opportunity within the energy sector, backed by a strong company with a rich history. With competitive dividend yields and growth potential in renewable energy, Enbridge Inc. remains an attractive option for investors. However, it is essential to consider market volatility and regulatory risks before making investment decisions. Engaging with this information can empower investors to make informed choices regarding ENB stock.

We invite readers to share their thoughts on ENB stock in the comments below, explore related articles for further insights, and stay informed about the dynamic energy market.

Thank you for reading! We look forward to welcoming you back for more insightful articles.

Unveiling Sam Asghari: The Journey Of A Rising Star

Eileen Davidson: A Journey Through Her Life And Career

Understanding Beam Stock: A Comprehensive Guide