Understanding ES Futures: A Comprehensive Guide

ES futures are a popular trading instrument among investors and traders who wish to gain exposure to the performance of the S&P 500 index. These futures contracts, which are standardized agreements to buy or sell a specific quantity of an asset at a predetermined price at a future date, offer a range of benefits for both hedgers and speculators. In this article, we will explore the ins and outs of ES futures, including their mechanics, benefits, risks, and trading strategies. Whether you are a seasoned trader or a newcomer to futures trading, this guide will equip you with the knowledge you need to navigate the world of ES futures effectively.

The ES futures market is one of the most liquid and widely traded futures markets in the world, providing opportunities for profit and risk management. Understanding how these contracts work is essential for anyone looking to participate in the financial markets. In this comprehensive guide, we will delve into the key aspects of ES futures, including their specifications, trading platforms, and market dynamics. We will also discuss strategies to consider when trading these contracts and the potential risks involved.

By the end of this article, you will not only have a thorough understanding of ES futures but also be better prepared to make informed trading decisions. Let’s begin our exploration of this fascinating financial instrument.

Table of Contents

- What Are ES Futures?

- Biography and Specifications of ES Futures

- How Do ES Futures Work?

- Benefits of Trading ES Futures

- Risks of ES Futures

- Trading Strategies for ES Futures

- Choosing a Broker for ES Futures

- Conclusion

What Are ES Futures?

ES futures, also known as E-mini S&P 500 futures, are futures contracts that track the performance of the S&P 500 index. They are traded on the Chicago Mercantile Exchange (CME) and are among the most popular and liquid futures contracts available in the market. The E-mini designation refers to the smaller contract size compared to the standard S&P 500 futures contract, making it accessible to a wider range of investors.

Key Features of ES Futures:

- Contract Size: Each ES futures contract represents $50 times the value of the S&P 500 index.

- Tick Size: The minimum price fluctuation for ES futures is 0.25 index points, which equals $12.50.

- Trading Hours: ES futures can be traded almost 24 hours a day, allowing for flexibility and responsiveness to market events.

- Leverage: Futures trading typically involves a margin requirement, enabling traders to control a large position with a relatively small amount of capital.

Biography and Specifications of ES Futures

To understand ES futures better, it's essential to look at their specifications and the historical context behind their creation. The E-mini S&P 500 futures were introduced in 1997, providing a more affordable option for traders looking to participate in the S&P 500 index without the need to trade full-sized contracts.

| Specification | Details |

|---|---|

| Exchange | Chicago Mercantile Exchange (CME) |

| Contract Symbol | ES |

| Contract Size | $50 x S&P 500 Index |

| Minimum Price Fluctuation | 0.25 Index Points ($12.50) |

| Margin Requirement | Varies by broker and market conditions |

How Do ES Futures Work?

Understanding how ES futures operate is crucial for successful trading. These contracts allow traders to speculate on the future value of the S&P 500 index, either by going long (buying) or short (selling). When a trader buys an ES futures contract, they are essentially betting that the index will rise. Conversely, selling a contract indicates a belief that the index will fall.

When trading ES futures, it's important to be aware of the following concepts:

- Margin and Leverage: Traders are required to maintain a margin account, which allows them to control larger positions with less capital.

- Settlement: ES futures are cash-settled, meaning that at expiration, the difference between the contract price and the final settlement price is paid in cash.

- Market Orders vs. Limit Orders: Traders can use different types of orders to enter and exit positions, depending on their trading strategy and market conditions.

Benefits of Trading ES Futures

There are several advantages to trading ES futures, making them an attractive option for many investors:

- Liquidity: The ES futures market is one of the most liquid markets, allowing for easy entry and exit of positions.

- Diversification: Trading ES futures provides exposure to a broad range of stocks in the S&P 500, offering diversification benefits.

- Hedging Opportunities: Investors can use ES futures to hedge against potential losses in their equity portfolios.

- Flexibility: With the ability to trade nearly 24/7, traders can react to market news and events in real-time.

Risks of ES Futures

While trading ES futures can be profitable, it also comes with inherent risks that traders should be aware of:

- Market Volatility: Futures markets can be highly volatile, leading to rapid price swings that can result in significant losses.

- Leverage Risk: While leverage can amplify profits, it can also magnify losses, making risk management essential.

- Margin Calls: If the market moves against a trader's position, they may face margin calls, requiring them to deposit additional funds to maintain their position.

Trading Strategies for ES Futures

To maximize success with ES futures, traders often employ various trading strategies. Here are a few popular approaches:

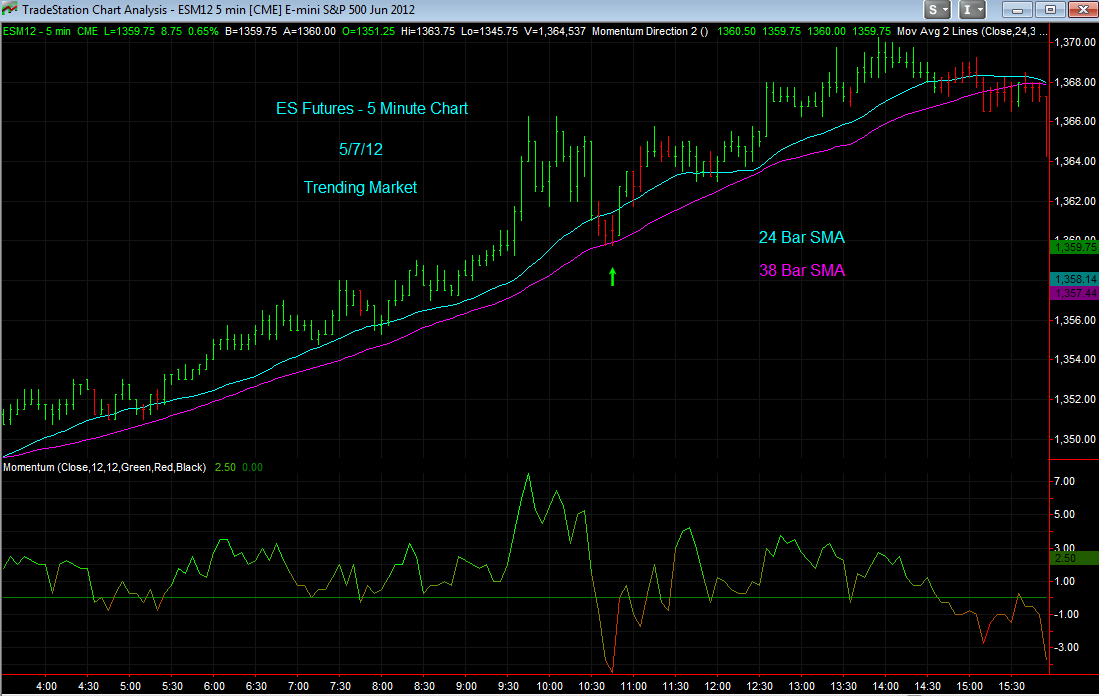

- Day Trading: This strategy involves opening and closing positions within the same trading day to capitalize on short-term price movements.

- Swing Trading: Traders hold positions for several days or weeks, aiming to profit from longer-term price trends.

- Scalping: This strategy focuses on making small profits from numerous trades throughout the day.

Choosing a Broker for ES Futures

Selecting the right broker is crucial for trading ES futures effectively. Here are some factors to consider:

- Regulation: Ensure that the broker is regulated by a reputable authority to protect your funds.

- Trading Platform: Look for a user-friendly trading platform with advanced tools for analysis and order execution.

- Fees and Commissions: Compare fees and commissions to find a broker that offers competitive pricing.

Conclusion

In conclusion, ES futures offer a powerful way for traders to gain exposure to the S&P 500 index while enjoying the benefits of liquidity, diversification, and trading flexibility. However, it is essential to understand the risks involved and to develop a sound trading strategy. By leveraging the knowledge gained from this comprehensive guide, you can navigate the world of ES futures with confidence and make informed trading decisions.

We encourage you to share your thoughts in the comments below or explore more articles on our site to further enhance your trading knowledge.

Final Thoughts

Thank you for taking the time to read this comprehensive guide on ES futures. We hope that you found it informative and beneficial for your trading journey. We invite you to return for more insightful articles and updates in the future!

Kayla Nicole: The Inspiring Journey Of Travis Kelce's Partner

The Power Of Friendship: Building Lasting Bonds In Life

Yahoo Finance: Your Ultimate Guide To Financial News And Insights