Understanding VYM Stock: A Comprehensive Guide For Investors

VYM stock, or the Vanguard High Dividend Yield ETF, is a popular investment choice among those seeking income through dividends. This exchange-traded fund (ETF) aims to provide investors with exposure to a diversified portfolio of high-yielding U.S. stocks. In this article, we will explore everything you need to know about VYM stock, including its performance, investment strategy, and its relevance in today’s financial market.

As more investors seek to generate passive income, understanding the nuances of VYM stock becomes essential. This article will guide you through the details of this ETF, including its history, holdings, and the factors influencing its performance. By the end of this article, you will have a comprehensive understanding of VYM stock and how it can fit into your investment portfolio.

Whether you are a seasoned investor or just starting, this guide will provide valuable insights into VYM stock, helping you make informed investment decisions. Let’s dive into the world of VYM stock and uncover its potential benefits and risks.

Table of Contents

- What is VYM Stock?

- Biography of VYM Stock

- Investment Strategy of VYM

- Performance Analysis

- Top Holdings in VYM

- Costs and Expenses

- Tax Implications of VYM

- Conclusion

What is VYM Stock?

VYM stock is an exchange-traded fund (ETF) managed by Vanguard that focuses on high dividend yield stocks. This ETF aims to track the performance of the FTSE High Dividend Yield Index, which includes companies that pay high dividends relative to their share prices.

Investing in VYM stock allows investors to gain exposure to a diversified portfolio of established companies known for their consistent dividend payouts. This makes VYM an attractive option for income-seeking investors who wish to add a steady stream of cash flow to their investment strategy.

Biography of VYM Stock

| Detail | Information |

|---|---|

| Name | Vanguard High Dividend Yield ETF |

| Ticker Symbol | VYM |

| Inception Date | November 10, 2006 |

| Management | Vanguard Group |

| Investment Objective | Provide a high level of income |

Investment Strategy of VYM

The investment strategy of VYM stock revolves around selecting companies that not only pay dividends but also have a history of increasing their dividends over time. The ETF primarily invests in large-cap U.S. stocks across various sectors, focusing on those with high dividend yields.

Key components of VYM's investment strategy include:

- **Diversification:** VYM invests in a wide range of sectors to mitigate risk.

- **Dividend Growth:** The fund emphasizes companies that have a history of growing their dividends.

- **Low Expense Ratio:** VYM offers a competitive expense ratio compared to other funds in its category.

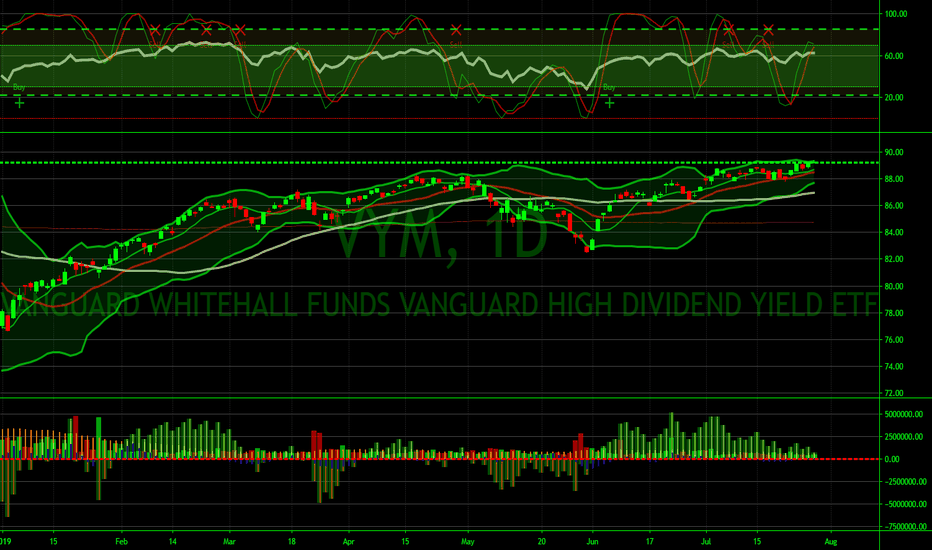

Performance Analysis

To evaluate the performance of VYM stock, it is essential to consider its historical returns, dividend yield, and how it compares to other investment options. Historically, VYM has provided strong returns, especially during periods of market volatility.

Some key performance indicators include:

- **Annualized Return:** VYM has consistently delivered attractive annualized returns over the long term.

- **Dividend Yield:** VYM typically offers a higher dividend yield compared to the broader market.

- **Risk Metrics:** An analysis of the ETF's beta and standard deviation can provide insights into its risk profile.

Top Holdings in VYM

VYM stock holds a diversified portfolio of companies, with a focus on large-cap stocks known for their dividend payments. Some of the top holdings in VYM include:

- Johnson & Johnson

- Procter & Gamble

- ExxonMobil

- Coca-Cola

- PepsiCo

This diverse range of holdings helps mitigate risk while providing exposure to companies with strong fundamentals and a commitment to returning capital to shareholders.

Costs and Expenses

When investing in VYM stock, it is important to consider the associated costs and expenses. VYM boasts a low expense ratio, making it an attractive choice for cost-conscious investors.

Key cost considerations include:

- **Expense Ratio:** VYM has a low expense ratio compared to many actively managed funds.

- **Trading Costs:** Investors should also be aware of potential trading costs when buying or selling shares of the ETF.

Tax Implications of VYM

Investing in VYM stock may have tax implications, especially concerning dividends. Understanding these implications is crucial for investors seeking to maximize their after-tax returns.

Some tax considerations include:

- **Qualified Dividends:** Many of the dividends paid by VYM may qualify for lower tax rates.

- **Capital Gains:** Investors may also incur capital gains taxes when selling shares at a profit.

Conclusion

VYM stock, or the Vanguard High Dividend Yield ETF, presents a compelling investment opportunity for those seeking income through dividends. With its focus on high-quality, dividend-paying companies, VYM offers a diversified approach to generating passive income. By understanding its investment strategy, performance, and associated costs, investors can make informed decisions about incorporating VYM into their portfolios.

As you consider your investment options, remember to conduct thorough research and consult with a financial advisor if needed. If you found this article helpful, please leave a comment, share it with others, or explore more articles on our site for further insights.

Thank you for reading, and we look forward to providing you with more valuable investment insights in the future!

The Comprehensive Guide To Yahoo.com: Everything You Need To Know

Masters 2024: Everything You Need To Know About The Prestigious Golf Tournament

AT&T Currently: A Comprehensive Overview Of Services, Plans, And Innovations